The Hidden Costs of Dying Without a Will in Barbados (and How to Avoid Them)

Introduction

For twenty-five years, James treated Marcus like his own son. When Marcus's biological father, David, died in a car accident, James, David's closest friend, took in 8-year-old Marcus, paid for his education, and guided him through life. Marcus called him "Dad."

When James passed away suddenly at 67, Marcus naturally assumed he would help settle the estate. He'd been handling James's affairs for years and understood his wishes better than anyone.

Instead, Marcus discovered a sobering reality: under Barbados intestacy law, he had no legal standing. James had never formally adopted him.

While Marcus arranged the funeral, a distant nephew appeared with legal documentation claiming the entire estate. Someone James had mentioned only once or twice became the sole beneficiary simply through bloodline.

"Twenty-five years meant nothing. The law doesn't recognise love or bonds. It only recognises blood," Marcus said quietly.

When someone dies without a valid will, known as dying "intestate", intestacy rules under Barbadian law, not personal wishes, determine who inherits what. The consequences extend far beyond money, creating rifts that destroy families permanently.

This article reveals four hidden costs that arise when estate planning is neglected, and provides a roadmap to protect your family from unnecessary conflict, delays, and heartbreak.

Understanding Intestacy in Barbados

When someone dies without a valid will in Barbados, their estate is distributed according to the Succession Act, Cap. 249. Without a will to express their wishes, the law determines who inherits based on a predetermined order of family relationships, regardless of personal bonds.

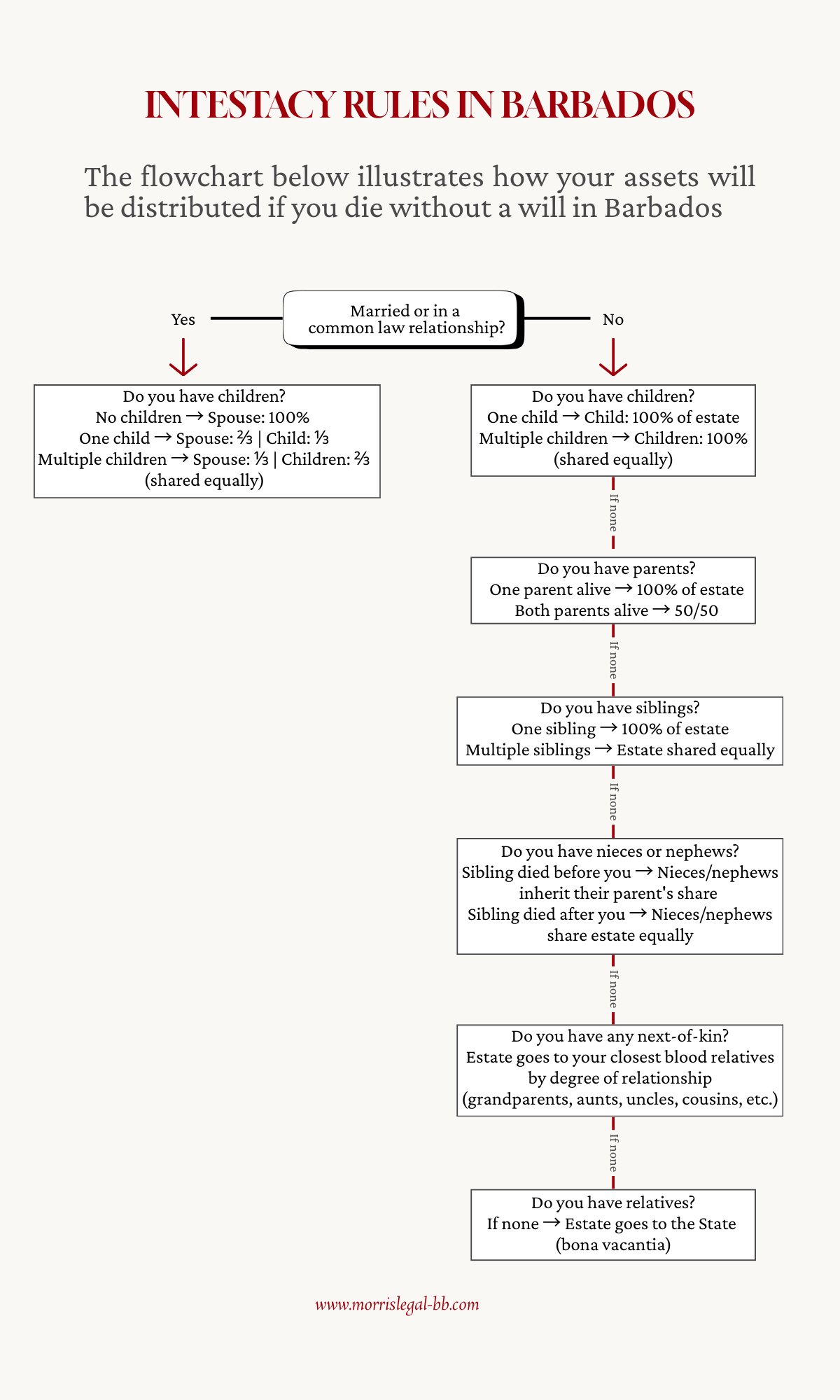

Here's exactly how your estate would be divided under Barbados intestacy law:

Please note: This flowchart provides a general overview of intestacy rules in Barbados for educational purposes only. It does not constitute legal advice. Individual circumstances may vary, and we recommend consulting with a qualified attorney to understand how these rules apply to your specific situation.

If you have a spouse but no children:

Your spouse inherits 100% of your estate

If you have a spouse and one child:

Your spouse receives ⅔ of your estate Your child receives ⅓ of your estate

If you have a spouse and multiple children:

Your spouse receives ⅓ of your estate Your children share ⅔ equally among themselves

If you have children but no spouse:

Your children inherit 100% of your estate in equal shares

Important: The 5-Year Common Law Rule

For couples in common law relationships, you must have lived together continuously for at least five years immediately before death to be considered a "spouse" under Barbadian law. Without meeting this requirement, your partner has no automatic legal claim to your estate.

If you have no spouse or children, the estate passes down this hierarchy:

1. Your parents first

If both parents are alive: they share the estate equally (50% each). If only one parent is alive: that parent receives 100%. If both parents are deceased: the estate moves to the next level ↓

2. Your siblings (only if both parents are deceased)

If you have living siblings: they share the estate equally If a sibling died before you but left children: that sibling's children (your nieces/nephews) inherit their parent's share If you have no living siblings and no nieces/nephews from deceased siblings: the estate moves to the next level ↓

3. Your nieces and nephews (only if you have no parents, no living siblings, and no children of deceased siblings)

They share the estate equally among themselves If you have no nieces or nephews: the estate moves to the next level ↓

4. Your next-of-kin (only if none of the above relatives exist)

The estate goes to your closest blood relatives by degree of relationship (grandparents, aunts, uncles, cousins, etc.) If no blood relatives can be found: the estate moves to the final level ↓

5. The State (only if no relatives exist at all)

The estate goes to the State (known legally as bona vacantia)

The Four Hidden Costs of Dying Without a Will

Hidden Cost #1: Family Conflict and Lost Harmony

Lack of proper estate planning creates fertile ground for family disputes that can permanently destroy relationships. When there's no clear documentation of your wishes, family members often operate on different assumptions about what you "would have wanted," leading to conflicts that tear families apart.

Common Sources of Conflict:

Verbal Promises vs. Legal Reality: Family members who received verbal assurances about inheritance often discover these promises hold no legal weight. A sibling told they'd inherit the family home, or a child promised specific investments, has no legal recourse when the estate gets divided according to statutory rules.

Blended Family Complexities: Modern families often include step-children, adopted children, and other non-biological relationships. A father who raised his late wife's children from a previous relationship alongside his own biological children may intend for all children to be treated equally, but intestacy law only recognises his biological children and any he legally adopted, not the stepchildren he never formally adopted.

The Emotional and Financial Toll

Family conflicts over intestate estates frequently result in years of expensive litigation, permanent family estrangement, and the loss of family unity during a time when support is most needed.

The tragedy is that most of these conflicts are entirely preventable with clear, legally documented estate planning.

Ready to Get Started?

If you'd like to discuss how estate planning can protect your family and ensure your wishes are honoured, schedule a call with our office.

Hidden Cost #2: Unintended Beneficiaries

When someone dies intestate, Barbados law follows a predetermined order based on blood relations and legal marriage or common law spousal status. This structure can result in estates going to people the deceased never intended to benefit, while excluding those they considered family.

Marcus's experience demonstrates exactly how this works in practice. Despite being raised by James for twenty-five years, Marcus had no legal claim to the estate because he wasn't formally adopted. The inheritance went instead to a distant nephew James had rarely mentioned—someone who never expected the inheritance, but who became the legal beneficiary simply through bloodline.

This scenario plays out in various family situations:

Step-children who were raised from childhood may receive nothing if their step-parent dies before formally adopting them.

Partners who lived together for years but fell short of the five-year legal requirement may find themselves with no claim to the estate.

Long-term caregivers, close family friends, or chosen family members who provided daily support have no standing under intestacy law.

On the other hand, your estate may go to relatives you'd prefer not to benefit:

An estranged sibling who hasn't spoken to you for decades stands in line to inherit before a devoted friend who provided years of care. A biological child who disappeared from your life inherits equally with children who remained close and supportive.

Without a will, the law determines distribution based on a predetermined order, regardless of your intentions or the reality of your family relationships.

Hidden Cost #3: Emotional and Administrative Burden

The process of determining what the deceased owned, what they owed, and how to manage their affairs requires detailed knowledge and considerable time, particularly challenging when the deceased never documented these matters or discussed them with those who must handle the estate.

Comprehensive Asset and Liability Assessment

Without proper estate planning, surviving family members must scramble to identify and value all assets. When someone plans their estate, these details are typically documented with their attorney and discussed with their chosen executor. Without planning, families must discover everything from scratch: real estate, financial accounts, personal property, business interests, insurance policies, and digital assets, while simultaneously identifying and addressing all debts and obligations.

Administrative Complexity

If the deceased owned or operated a business, surviving family members may suddenly find themselves responsible for daily operations, employee management, customer relationships, and financial obligations that cannot wait for the estate process to conclude. Throughout the administration period, someone must also manage property maintenance, insurance renewals, and investment decisions to protect the estate's value.

When Families Are Least Prepared

These overwhelming responsibilities fall on family members during an already difficult period, when they're grieving and least equipped to handle complex administrative tasks. The lack of preparation and documentation turns what should be a manageable process into a source of additional stress and potential family conflict.

Hidden Cost #4: Lost Legacy and Personal Values

Beyond the financial and administrative challenges, intestacy can result in the loss of your personal legacy: the intangible values, family history, and meaningful connections that cannot be preserved through legal formulas alone.

When Personal History Disappears

When your assets are distributed according to statutory rules rather than personal intention, meaningful items may lose their significance. The handcrafted dining table made by a grandfather gets divided based on monetary value rather than family tradition. Vintage photographs that tell the family's story may be discarded as having no financial worth. Personal collections get distributed to whoever can use them rather than those who appreciate their meaning.

Lost Opportunities for Impact

Without a will, there's no mechanism to honour your charitable commitments, community involvement, or educational support for family members. A will provides an opportunity to communicate final thoughts and values, but intestacy eliminates this entirely, leaving no way to pass on life lessons to children and grandchildren, provide explanations for distribution decisions, or share personal values to guide future generations.

Preserving What Matters Most

A Letter of Wishes is a powerful tool for preserving personal legacy by explaining the reasoning behind specific distributions, sharing personal stories about meaningful items, and expressing hopes for family members' futures. While not legally binding, it provides guidance and context that helps loved ones understand your intentions and preserve what matters most.

Taking Control: How to Protect Your Family

The four hidden costs outlined above: family conflict, unintended beneficiaries, administrative burden, and lost legacy are entirely preventable with proper estate planning.

At the Law Office of Lyngeolle Morris, we guide families through a comprehensive process that addresses both the legal requirements and your unique family dynamics:

Our Estate Planning Process:

Discovery & Planning – We work with you to identify your assets, understand your family circumstances, and develop a distribution strategy that reflects your values.

Executor Selection – We guide you through selecting an executor—the person responsible for carrying out your wishes. We'll help you understand what makes a suitable executor, the importance of naming a backup, and how to discuss this responsibility with your chosen individuals before finalising your will.

Legal Documentation – Once you've decided on your beneficiaries and how you want your assets distributed, we prepare all the necessary documents to formalise your final wishes

Ongoing Support – We assist with periodic reviews and updates to your will as your life circumstances, family situation, and the law change over time.

This approach ensures your estate plan prevents the conflicts, unintended outcomes, and administrative burdens that can devastate families.

You Don't Have to Face This Alone

If you've read this far, you're probably thinking about your own family. Maybe you're wondering how these rules would apply to your situation, or you're concerned about relationships or assets that don't fit neatly into legal categories. Perhaps you're simply ready to stop worrying about "what if" and start creating the security your family deserves.

When you're ready, we'll walk through your specific situation together. No pressure, no rush. Just an honest discussion about your family, your concerns, and what would give you peace of mind.

We'll help you understand exactly how Barbados law would handle your estate today, and then we'll work with you to create a plan that reflects your intentions.

Estate planning doesn't have to be overwhelming. It's simply about making sure the people you love are taken care of the way you'd want them to be.

Schedule a consultation or send us your questions to get started. Let's create the peace of mind you and your family deserve.